Debunkery Audiobook Summary

Want to become a better investor? Send your spouse on a shopping spree! It’s no joke–this book shows you why.

Far too many investors fail to get the results they want because they make some pretty common mistakes. The problem is, the errors don’t seem like mistakes–they seem like smart, intuitive, and/or widely recognized investing “wisdom.” But much of what’s accepted as investing “wisdom” is, instead, bunk. How can investors tell bunk from reality?

Debunkery: Learn It, Do It, and Profit From It–Seeing Through Wall Street’s Money-Killing Myths from legendary money manager, longtime Forbes columnist, and best-selling author Ken Fisher shows you how to avoid the costly errors many investors make when they rely upon “common sense” thinking, intuition, gut instinct, or cliches–by using debunkery! Debunkery isn’t difficult–it just requires the willingness to flip common investing “wisdom” on its head. Once readers learn to do that, they can begin seeing the investing world more clearly and stop falling prey to costly bunk.

Fisher demonstrates debunkery on 50 of Wall Street’s widely accepted “truths,” and details in an easily accessible (and always entertaining) way why:

- Stop-losses could be renamed stop-gains.

- High unemployment isn’t bad for stocks.

- Massive trade deficits can be great for stocks.

- Stocks don’t care if the US dollar is strong or weak.

- Most retirees have a long, long time to invest.

- You should never listen to your “gut” when it comes to investing.

- You are almost certainly too terrified of government debt.

- Consumer confidence doesn’t matter.

- Sending your spouse on a shopping spree could get you better long-term investing results.

In investing, there are no simple rules that say, “always sell on this one condition, and buy on that one,” that work consistently and repeatedly. If only investing were that easy!

Debunkery shows you why many Wall Street “truths” are, in reality, money-killing myths and walks you through ways you can begin improving your error rate right away. Debunkery debunks 50 common myths, but also gives you the tools to continue engaging in debunkery for the rest of your investing career.

Other Top Audiobooks

Debunkery Audiobook Narrator

John Morgan is the narrator of Debunkery audiobook that was written by Ken Fisher

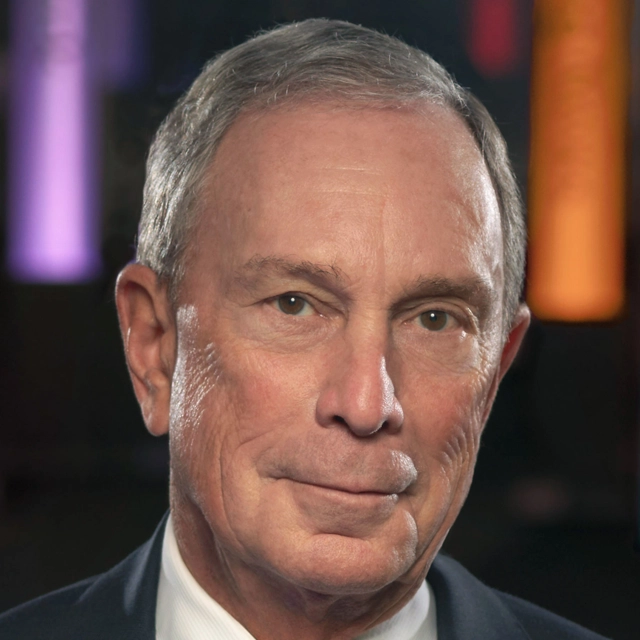

Ken Fisher is best known for his prestigious “Portfolio Strategy” column in Forbes Magazine, the fourth longest-running columnist in Forbes’ ninety-year history. He is also founder, Chairman, and CEO of Fisher Investments, an independent global money management firm with over $45 billion in assets. He is the award-winning author of numerous scholarly articles and has published four previous major finance books, including 2006’s New York Times bestseller The Only Three Questions That Count. He has a weekly column in Handelsblatt, Germany’s leading finance daily.

About the Author(s) of Debunkery

Ken Fisher is the author of Debunkery

More From the Same

- Author : Ken Fisher

- How to Smell a Rat

- The Ten Roads to Riches, Second Edition

- The Ten Roads to Riches

- Publisher : HarperAudio

- Abraham

- American Gods [TV Tie-In]

- Dead Ringer

- House of Sand and Fog

- Prey

Debunkery Full Details

| Narrator | John Morgan |

| Length | 7 hours 42 minutes |

| Author | Ken Fisher |

| Publisher | HarperAudio |

| Release date | November 02, 2010 |

| ISBN | 9780061672576 |

Additional info

The publisher of the Debunkery is HarperAudio. The imprint is HarperAudio. It is supplied by HarperAudio. The ISBN-13 is 9780061672576.

Global Availability

This book is only available in the United States.

Goodreads Reviews

John

January 27, 2011

I'm rather surprised by the low rating on this book by the other reviewer. Ken Fisher is one of the most successful and well regarded investment managers in the world. He is constantly on the prowl of proof of trends that matter, combinations of indicators that mean something, at least for a relatively short period of time. His description of 50 widely accepted Wall Street "truths" and his factual support for their fallability is excellent, even if the theme is repeated so often. Perhaps the other reader wanted to learn what does work in selecting investments. Clearly this was not the book written for that purpose. Anyone who has read Fisher's 2006 book "The Only Three Questions That Count: Investing by Knowing What Others Don't" would realize that he is critical of any one factor or trend having predictive value in terms of stock market direction.

Brad

October 22, 2017

I have been investing off and on for most of my life as a private investor. I have been successful using blind luck, and horribly unsuccessful when I let fear get to me. I have read many investing books over time, and have come to believe most of them are bunk. Some work for a short time, others not at all. What I find that I like about Ken Fisher's books, are that it does a much better job of explaining the why behind successful investors in a believable, and verifiable way. It's a fundamental truth that what most of us "know" is either wrong or priced in to the market. already and hence not an edge. It's very difficult to know something others don't in regards to investing. Being able to find technologies that you can test and verify, while still getting broad coverage in the market is a powerful concept that get's easily lost in the "get rich quick" investing books. I highly recommend this book. even if you don't plan to do the investing yourself, it pays to be armed with facts when talking to your investment adviser so you know if nothing else, when to walk away.

Man

January 01, 2023

I listened to Ken Fisher's interview podcast on Master In Business podcast of Barry Ritzholt while taking an MBA online program. I admired his knowledge and his point of view on banking investment and capital investment. Even though I wrote down the book's name, I did not have a chance to listen to the entire audiobook. This book describes every single angle of information talking about the stock market. We heard from multiple news, such as SAR-COV-1, terrorism, 1987 events, 2003 events, IRA, political scandals, and healthcare innovation (new drugs and new vaccines). We heard abundant of information and public business meeting from the CEOs about their companies. However, we never question how the information or news impacts our portfolio, how relevant the news is to the stock market, and how fast the information gets impacted. There are numbers and charts represented in your daily view, and we wonder if we know how to utilize the charts or data to diversify our portfolio.In addition, we know the US economy has debt and the world's financial capital, and money flows in and out of the US market. We are all consumers or investors in the US economy. If the funds flow around, the stock market can go up and down depending on the volatility rate. Ken did emphasize how we understood all the principles and factors of the financial world or investment based on the variety of information. He split up into 50 bunks to make a clear point about all the information the investors commonly hear, see, read, and analyze for the portfolio. It's very informative and great discussion to analyze and understand the investment world.

Tony

April 21, 2019

Helpful read as I attempt to add a zero or three to the bottom line.

taninounet

August 28, 2022

What to make of a book with a typo on the very first page ? Nothing is reliable.

Paul

September 23, 2022

I thought I knew a lot about investing, but I learned a lot from this book.

Dmitri

January 19, 2018

This book gave me some interesting perspecives that I did know before.

Brad

August 14, 2022

Excellent, quick, stands the test of time.

Silvia

November 04, 2022

Short review of your mistake. Cool

Remo

November 05, 2013

My first Ken Fisher book. I thought it was a decent investment book. Premise is to debunk myths about investing. He is very gung ho on the stock market, and relies on straight forward analysis to make his point. One of his points is to look at what makes up averages. One example is where he shows S&P 500 annual return ranges since 1926. Only 28.6% were there negative returns, 33.3% (28 occurrences) had average returns of 10-20%, and 38% of the time had returns greater than 20%. He also showed how the market did in each year of a presidency (since Coolidge).Fisher is pretty impressed with himself and repeats himself a lot. But that's typical for this type of book.

Christopher

May 06, 2011

Ken Fisher has an excellent book here! I found the 50 “bunks” to be quite helpful. He makes you look at the stock market with new eyes not clouded by public opinion. The book is easy to follow and understand but I feel that it is not meant for a beginner. I think that it would be better if you knew a little something about investing in stocks and some basic facts about the economy before you read this book. However, I may be wrong. Maybe this is one of the first books that you should read so that you can start off on the right path while you enter the wonderful world of investing.

Karel

February 28, 2015

Fun easy read on common investing mistakes. Great for newbies, even a few thought provoking ones for me.

Alexander

April 10, 2013

This was a lot of fun. Easy to read in small pieces, but some great information, charts, etc. Couldn't find anything to dislike.

Most Popular Audiobooks

Frequently asked questions

Listening to audiobooks not only easy, it is also very convenient. You can listen to audiobooks on almost every device. From your laptop to your smart phone or even a smart speaker like Apple HomePod or even Alexa. Here’s how you can get started listening to audiobooks.

- 1. Download your favorite audiobook app such as Speechify.

- 2. Sign up for an account.

- 3. Browse the library for the best audiobooks and select the first one for free

- 4. Download the audiobook file to your device

- 5. Open the Speechify audiobook app and select the audiobook you want to listen to.

- 6. Adjust the playback speed and other settings to your preference.

- 7. Press play and enjoy!

While you can listen to the bestsellers on almost any device, and preferences may vary, generally smart phones are offer the most convenience factor. You could be working out, grocery shopping, or even watching your dog in the dog park on a Saturday morning.

However, most audiobook apps work across multiple devices so you can pick up that riveting new Stephen King book you started at the dog park, back on your laptop when you get back home.

Speechify is one of the best apps for audiobooks. The pricing structure is the most competitive in the market and the app is easy to use. It features the best sellers and award winning authors. Listen to your favorite books or discover new ones and listen to real voice actors read to you. Getting started is easy, the first book is free.

Research showcasing the brain health benefits of reading on a regular basis is wide-ranging and undeniable. However, research comparing the benefits of reading vs listening is much more sparse. According to professor of psychology and author Dr. Kristen Willeumier, though, there is good reason to believe that the reading experience provided by audiobooks offers many of the same brain benefits as reading a physical book.

Audiobooks are recordings of books that are read aloud by a professional voice actor. The recordings are typically available for purchase and download in digital formats such as MP3, WMA, or AAC. They can also be streamed from online services like Speechify, Audible, AppleBooks, or Spotify.

You simply download the app onto your smart phone, create your account, and in Speechify, you can choose your first book, from our vast library of best-sellers and classics, to read for free.

Audiobooks, like real books can add up over time. Here’s where you can listen to audiobooks for free. Speechify let’s you read your first best seller for free. Apart from that, we have a vast selection of free audiobooks that you can enjoy. Get the same rich experience no matter if the book was free or not.

It depends. Yes, there are free audiobooks and paid audiobooks. Speechify offers a blend of both!

It varies. The easiest way depends on a few things. The app and service you use, which device, and platform. Speechify is the easiest way to listen to audiobooks. Downloading the app is quick. It is not a large app and does not eat up space on your iPhone or Android device.

Listening to audiobooks on your smart phone, with Speechify, is the easiest way to listen to audiobooks.