The Total Money Makeover Audiobook Summary

The success stories speak for themselves in this audio book from money maestro Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt and achieving total financial health.

Ramsey debunks the many myths of money (exposing the dangers of cash advance, rent-to-own, debt consolidation) and attacks the illusions and downright deceptions of the American dream, which encourages nothing but overspending and massive amounts of debt. “Don’t even consider keeping up with the Joneses,” Ramsey declares in his typically candid style. “They’re broke!”

The Total Money Makeover isn’t theory. It works every single time. It works because it is simple. It works because it gets to the heart of the money problems: you.

Other Top Audiobooks

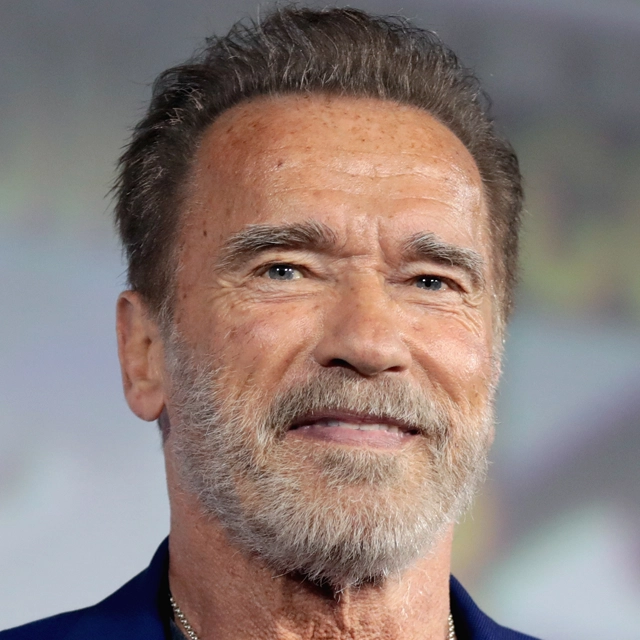

The Total Money Makeover Audiobook Narrator

Dave Ramsey is the narrator of The Total Money Makeover audiobook that was written by Dave Ramsey

Dave Ramsey is a #1 national bestselling author, personal finance expert, and host of The Dave Ramsey Show, heard by more than 16 million listeners each week. He’s authored seven national bestselling books including, The Total Money Makeover, EntreLeadership, and Smart Money Smart Kids. Since 1992 Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO for Ramsey Solutions.

About the Author(s) of The Total Money Makeover

Dave Ramsey is the author of The Total Money Makeover

More From the Same

The Total Money Makeover Full Details

| Narrator | Dave Ramsey |

| Length | 3 hours 41 minutes |

| Author | Dave Ramsey |

| Publisher | Thomas Nelson |

| Release date | June 30, 2009 |

| ISBN | 9781418575090 |

Additional info

The publisher of the The Total Money Makeover is Thomas Nelson. The imprint is Thomas Nelson. It is supplied by Thomas Nelson. The ISBN-13 is 9781418575090.

Global Availability

This book is only available in the United States.

Goodreads Reviews

Laura

September 07, 2007

Buy it, live it! An amazing system that's not a system--just living within one's means. Worth the investment many times over!

Melissa

February 09, 2022

I read Financial Peace years ago. We tried to live the plan, but looking back we could have done a lot better. The Total Money Makeover takes the same plan and breaks it down into more detailed babysteps. This REALLY works! We've had our $1000 emergency saving account for years now and have hardly had to dip into it because we really think through what an emergency is. Most of the time we have been able to wait a few weeks until the "extra paycheck," tax return or a bonus comes through instead of using our savings. The debt snowball really works. I was amazed when I saw how much money is going toward our last debt! It will only be a few more months to get it paid off. Yes, we did stop retirement for the past year--it was a simple form to fill out at work and only took a couple minutes. The money that was previously in our IRA is still growing, but we're not adding to it right now. When that debt is gone and we have our 3-6 month savings we'll start it up again. What doesn't make sense is having debt when you retire and using your money from your 401K/IRA to pay off the debt.This book is just common sense in a big way! There is so much peace in being in control of our money and our marriage is so much better because we have GOALS that we plan together. This book is a great gift for college graduations and weddings! We buy it on Dave Ramsey's website when it goes on sale for $10 a copy.Update: June 2018.I wrote the original post Jan 2008. We still follow this plan. We've been debt free for the past 10 years. no credit cards for even longer. My husband started his own company--debt free and has never borrowed money for it. We paid for six vehicles in cash (a "dave" car for my husband, a family van, then a truck to replaced the "Dave" vehicle, one replaced the worn out family vehicle, the others are the high schoolers and a college car. Currently have 4 good running, paid for vehicles). We have paid college tuition, missionary support and cash flowed a wedding. Our only debt is our house. It will get more attention after our children are grown. We've been amazed at what we can do by being intentional and planning large purchases, vacations and budgeting!

Christy

May 29, 2016

*Listened to the audio version of this book*

Shane

November 18, 2007

This book is a great step by step plan to help you get control of your finances by walking you through the 7 baby steps.1. Small Emergency Fund of $10002. Pay off all debt except house with debt snowball3. Fully Fund Emergency Fund to 3-6x of living expenses4. Invest 15% of income for retirement5. Fund kids college fund6. Pay off mortgage7. Have fun, give and investDefinitely a must read and the companion website www.mytotalmoneymakeover.com is hands down the best most practical website I've ever seen from making a budget to tracking all your goals to forums and plenty more.

Yolanda

March 02, 2016

I can not believe that I've spent the last 12 years working in the Accounting field being such a good steward of my employers money but could never get a good grasp on my own money. The Total Money Makeover book has helped me go from paycheck-to-paycheck-thinking to wealth-building-thinking. Once my eyes were opened (I read the book in 2 days) I knew my financial life would never be the same. I asked my husband to read the book and when he started sending me texts like: Do you know that if we invest X dollars in a good mutual fund from age 30 to age 70 that it will be around 5.5 million dollars?!! I knew Dave had him hook, line & sinker. A good percentage of our marital issues surrounded money but there are no arguments on that subject anymore. We understand what the short term goal is (get debt free) and what the long term goals are (remain debt free & build wealth) so most of the decisions have already been made. Once we saw what "keeping up with the Joneses" does to your greatest wealth building tool (income), we decided that we could cut our life down to "rice & beans" for 2 to 2 1/2 years, clean up the massive mess we had made, and reclaim the nearly $2,000 per month we were paying on debt. I sure wish we had this book as teenagers/ younger adults, I can only imagine where we would be now. But even still, my son will never remember how his parents where up to their eyeballs in debt. We still have about $35k (down from 73k) in consumer debt to go, but thank God our financial family tree has been changed forever.

Tim

March 14, 2008

This is a pretty decent plan for getting out of debt and starting to invest. In the time-honored tradition of such self-help books as How To Win Friends and Influence People, Ramsey uses personal stories from other people to drive his points home. But in essence, the plan is like this: 1) stop buying things, sell off everything you don't need, stop using credit cards, etc.2) save up a $1000 emergency fund3) throw all possible cash toward paying off your smallest debt4) once the first debt is paid off, throw all possible cash toward paying off your second smallest debt, and so on until all you have left is your mortgage (if you have one)5) save up a 3-6 month emergency fund6) start a college fund (if you have kids) and pay off your mortgage7) invest, have fun, etc.Oh, and while Ramsey uses some Bible quotes here and there, it's pretty easy to ignore the parts about "God's plan for you" and other religious nonsense, and focus on the financial advice.

Marlene

May 28, 2019

I'm temporarily - I hope - departing from my usual review style while life is crazy and we're in the construction zone. I'm trying this rather than no review at all. I'm basically going to make occasional notes as I read, which is not as satisfactory to me, but hopefully they'll still be helpful. 5/28/19: I'm not the financial manager for my home. My husband is. But I decided to listen to this book because I've heard good things about Dave Ramsey and his Financial Peace University course. We didn't take the course at our church because we didn't want to get rid of our credit cards and because we were decently happy with our financial system. However, right now money is a stressor for my husband because we're putting an expensive addition onto our house. So I decided to listen to it. I'm finding it very entertaining, and I am understanding what he's talking about. Which is great, because I've often been confused by the information finance managers have shared with us when we've had meetings with them in the past. I love how Mr. Ramsey outlines a plan with simple (in concept), concrete steps which he insists must be followed in order, no matter where you are in life. I'd recommend this book for anyone with an income. Period. I think I'm going to give it 5 stars because I think it's that good. But I'll be fair and wait until I'm done. Thomas Nelson is a Christian book publisher, but I think it's worth noting that the author rarely makes Christian references, and when it is it's usually a brief verse from the book of Proverbs. Proverbs does have a lot of wise things to say about money, so I think any non-Christian would not be turned off by this book. Now that I'm listening to this book, I'm eager to start our family financial meetings again (with my husband and two oldest children).5/28/19: I finished this today. I think my notes above pretty well sums up my thoughts on the book. I'd like my oldest son, who is nearly 16, to listen to it.

Sara

June 14, 2007

I love Dave Ramsey. We have been doing the Total Money Makeover since Jan 1 of this year (we started after reading Dave's book "Financial Peace") and we are already seeing plenty of success with our baby steps. We pay for everything in cash now and if we don't have the cash, we don't buy it. We've got an emergency fund in place and have used it when things came up - auto repairs, etc. And best of all, we are in debt reduction mode - we had cut up all the credit cards Jan 1 and now we only see balances getting smaller or eliminated.I highly recommend Dave's book. Wish I had found it as a younger person. He writes in an very straight-forward, easy to understand way, without being dry or dull.

Shelby

December 08, 2019

I'm currently obsessed with Dave Ramsey. I think everyone should read this book!!! And listen to his podcast and together we can change the culture of spending and consuming to one of living and giving like no one else!

Melanie

January 07, 2018

Very practical and biblically sound advice!This book will hit you in the gut and make you shake your head at the same time. It will be hard to listen to and even harder to do. But, will be beneficial to you in the end. Dave likens a lot of his advice to working out and getting in shape. He paints the view of someone working hard to ride his bike up the mountain, pushing all the way to the top with "gazelle" like attitude. Once there, enjoy the wind and breeze flying down.I like this book for many reasons and already do the concepts presented in this book. We've been applying many of these biblical truths and wisdom from early on in our marriage. It's refreshing to see others doing the same and helping people in the process. What doesn't work for me in the book is that is is solely based off the US economy. His advice is for the average couple or person making $50, 000 per year, give or take. It's impractical when comparing to other places in the world and this is where I see a big difference. When we compare "free money" after the snowball debt and you've saved enough to live off of for 3-6 months, he talks about putting 15% of your income into various things to gain wealth including retirement savings plans (that are also different in other countries - so keep that in mind) and saving for your children's college, etc. From there, it's the last steps into investing where you really build the wealth and have your money working for you. Here is the but...But, in most places, with that income average, there is no "free money" and everything is spoken for because of living expenses. They can get out of debt by a lot of hard work, selling things, etc. But to put %15 away is unrealistic to places where I live compared to where the author lives. When the average in income is approx. the same as US at $50, 000, BUT living expenses are 13 - 21 % more higher on average, what do you do? Here is the latest comparison as of this year 2017 and I feel very accurate: https://www.expatistan.com/cost-of-li...?Don't get me wrong. Applying the principles laid out, will benefit you greatly and start the upward climb to getting victory over financial problems. And debt free, no doubt! But if it comes down to living expenses. There is no solid advice, except move from where those living expenses are high.Moving isn't always an option. Nor is commuting. There is a lot to consider with both suggestions...Prices of gas in comparison are 15 - 45% higher in some places and that is not considering wear-n-tear on the vehicle at all. It might mean losing the better paying job to relocate. And in Canada (and for many international areas), job security is sometimes more of a risk when thinking of quitting to relocate and find better housing. It truly can be a gamble with you being on the losing end.So, I wish there was a better portion of this book that spoke to other International places. Or maybe even a book on International economies with wisdom that is biblical and maybe more realistic to those specific countries? Regardless, biblical principles is always the right way to go. We are debt free by doing the very things mentioned in this book. And I am glad to have found someone explaining these ideals for the US and hopefully soon, making them more realistic for others all over the world :D

Jeremy

February 02, 2011

Thank you Tulsa Blizzard 2011 for helping me finish this book in two days. What makes this book so effective and successful is that it lays out a very appealing vision, which motivates the reader to make the dramatic changes necessary to become financially secure. By the end of the book, you are motivated and energized to do whatever it takes to achieve the vision of wealth described in this book. The best part is that it’s totally doable and no kind of hoax. Like the author says, there’s no excuse for any American not to retire with dignity. Quotes:Only the financial goobers like to complicate things for the sake of justifying their existence or justifying how much they paid for their education.Consumer confidence is that thing economists use to measure how much you will overspend due to your being giddy about how great the economy is, never taking into consideration that you are going deeply into debt.I love my stupid car more than the idea of becoming wealthy enough to give cars away.The USA Today reports that out of one hundred people age sixty-five, ninety-seven of them can’t write a check for $600, fifty-four are still working, and three are financially secure.When selecting and working with your wealth team, it is vital to bring on only members who have the heart of a teacher, not the heart of a salesman or the heart of an “expert...” Also, when taking advice, evaluate if the person giving the advice will profit from the advice.It is the duty of the good people to get wealth to keep it from the bad people, because the good people will do good with it.

Emma

October 04, 2022

money man!i’m working on it! I liked listening to his audiobook of this because you can really feel his passion for personal finance. 4.8/5 because I feel like I have financial direction now. Thanks Dave

Nikita

January 03, 2021

Brilliant and practical guide to managing a debt free financial lifestyle.

Cassie

April 14, 2020

This was really helpful and simple. I just finished college and didn't know absolutely anything about budgeting or financial planning and I feel a lot more comfortable now. I started the steps and it seems great.

Frequently asked questions

Listening to audiobooks not only easy, it is also very convenient. You can listen to audiobooks on almost every device. From your laptop to your smart phone or even a smart speaker like Apple HomePod or even Alexa. Here’s how you can get started listening to audiobooks.

- 1. Download your favorite audiobook app such as Speechify.

- 2. Sign up for an account.

- 3. Browse the library for the best audiobooks and select the first one for free

- 4. Download the audiobook file to your device

- 5. Open the Speechify audiobook app and select the audiobook you want to listen to.

- 6. Adjust the playback speed and other settings to your preference.

- 7. Press play and enjoy!

While you can listen to the bestsellers on almost any device, and preferences may vary, generally smart phones are offer the most convenience factor. You could be working out, grocery shopping, or even watching your dog in the dog park on a Saturday morning.

However, most audiobook apps work across multiple devices so you can pick up that riveting new Stephen King book you started at the dog park, back on your laptop when you get back home.

Speechify is one of the best apps for audiobooks. The pricing structure is the most competitive in the market and the app is easy to use. It features the best sellers and award winning authors. Listen to your favorite books or discover new ones and listen to real voice actors read to you. Getting started is easy, the first book is free.

Research showcasing the brain health benefits of reading on a regular basis is wide-ranging and undeniable. However, research comparing the benefits of reading vs listening is much more sparse. According to professor of psychology and author Dr. Kristen Willeumier, though, there is good reason to believe that the reading experience provided by audiobooks offers many of the same brain benefits as reading a physical book.

Audiobooks are recordings of books that are read aloud by a professional voice actor. The recordings are typically available for purchase and download in digital formats such as MP3, WMA, or AAC. They can also be streamed from online services like Speechify, Audible, AppleBooks, or Spotify.

You simply download the app onto your smart phone, create your account, and in Speechify, you can choose your first book, from our vast library of best-sellers and classics, to read for free.

Audiobooks, like real books can add up over time. Here’s where you can listen to audiobooks for free. Speechify let’s you read your first best seller for free. Apart from that, we have a vast selection of free audiobooks that you can enjoy. Get the same rich experience no matter if the book was free or not.

It depends. Yes, there are free audiobooks and paid audiobooks. Speechify offers a blend of both!

It varies. The easiest way depends on a few things. The app and service you use, which device, and platform. Speechify is the easiest way to listen to audiobooks. Downloading the app is quick. It is not a large app and does not eat up space on your iPhone or Android device.

Listening to audiobooks on your smart phone, with Speechify, is the easiest way to listen to audiobooks.